In the world of investing, where patience, research, and intuition often lead to wealth creation, Dolly Khanna stands out as a silent force. Known for her remarkable success in small-cap and mid-cap investments, Dolly Khanna has become a household name for retail investors. What makes her journey even more fascinating is the access to insights through the Dolly Khanna Blog, which serves as a gateway into the mind of this successful investor. This article explores the contents, importance, and strategies discussed on the Dolly Khanna blog, and why her portfolio decisions matter to aspiring investors.

Who is Dolly Khanna?

Dolly Khanna is a Chennai-based investor known for her ability to identify lesser-known companies with the potential to become multibaggers. She made her mark in the stock market with investments in small-cap stocks that later yielded extraordinary returns. Although her portfolio management is overseen by her husband, Rajiv Khanna, it is the joint effort of this couple that has led to their enormous success. The Dolly Khanna blog reflects their strategies and stock preferences, offering readers valuable insights on investing trends.

Her husband, Rajiv, an IIT-Madras graduate, initially made his fortune by founding Kwality Milk Foods in 1986, which they later sold to Hindustan Unilever. After moving the proceeds into fixed deposits, the couple transitioned into equity markets. Building what is now known as the Dolly Khanna portfolio.

What Does the Dolly Khanna Blog Offer?

The Dolly Khanna blog provides a unique opportunity for readers to understand her investment strategies and portfolio movements. Investors often look to her decisions to guide their investments, especially because she focuses on stocks that are under the radar. Unlike other market influencers, Dolly Khanna rarely appears in public or in the media. So the blog serves as a crucial touchpoint for those seeking to learn from her.

The blog’s primary focus revolves around her portfolio updates, sectoral trends, and detailed analyses of companies she invests in. It highlights why she chooses specific stocks, providing a glimpse into her thought process. Which often combines deep research with a strong focus on fundamentals.

Her investment style favors businesses with strong management, stable growth potential, and unique market positioning, which she patiently holds over time. This approach aligns with her belief in long-term value creation, often resulting in multi-bagger returns for her stocks.

Read more: Prerna malhan age

Insights from the Dolly Khanna Blog Portfolio

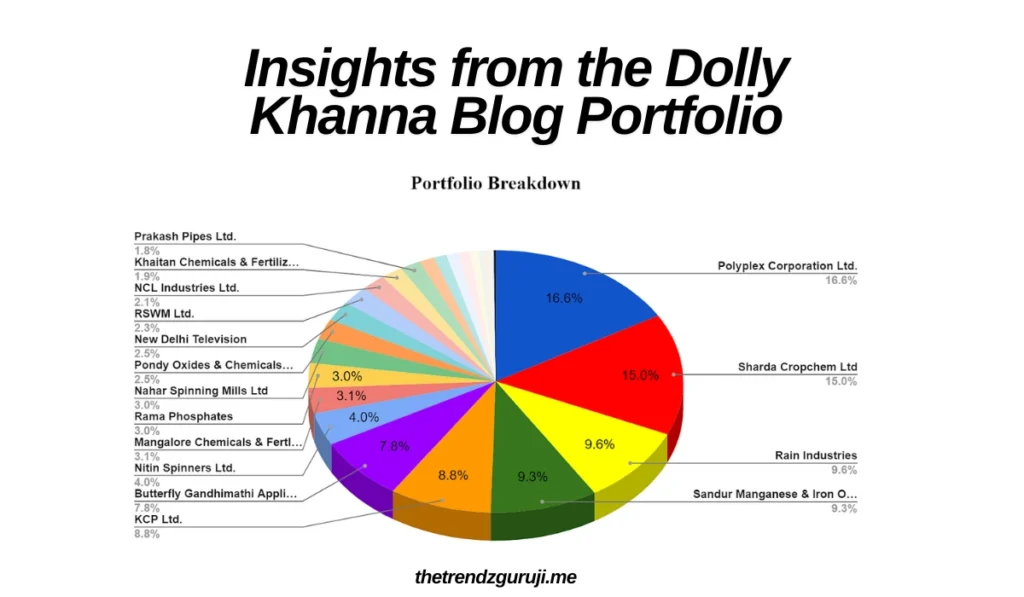

Dolly Khanna’s investments span multiple sectors, such as chemicals, textiles, FMCG, and industrial goods. Each blog update offers a look at the new companies she adds to her portfolio, often creating a ripple effect among investors. For instance, when she added Selan Exploration Technology Ltd to her portfolio in the first quarter of 2024, the stock gained significant market attention.

The Dolly Khanna blog meticulously tracks such movements, explaining why a certain sector or stock appeals to her at a given time. Investors who follow her blog can use this information to make informed decisions. Especially those interested in small-cap stocks with growth potential.

Overview of Key Holdings in Dolly Khanna’s Portfolio

| Company Name | Sector | Value (in Crores) | % Holding |

|---|---|---|---|

| Chennai Petroleum Corporation Ltd | Oil & Gas | 140.8 | 3.3% |

| Monte Carlo Fashions Ltd | Apparel | 32.0 | 1.8% |

| Pondy Oxides & Chemicals Ltd | Chemicals | 29.3 | 3.9% |

| Nitin Spinners Ltd | Textiles | 20.0 | 1.5% |

| Selan Exploration Technology Ltd | Energy | Not disclosed | 1.03% |

This snapshot of Dolly Khanna’s portfolio shows her knack for diversifying investments across sectors while maintaining a particular interest in chemicals and textiles. Her investment in energy stocks like Selan Exploration also indicates a growing focus on newer sectors poised for growth.

Strategies Discussed on the Dolly Khanna Blog

The Dolly Khanna blog offers readers a blueprint for understanding her investment strategies. One core principle she follows is value investing—identifying companies trading below their intrinsic value but with significant future potential. Unlike investors chasing market trends, Khanna focuses on fundamentally strong businesses that can grow steadily over time.

Her investment strategies revolve around patience, focusing on riding out market volatility. The blog emphasizes holding investments for years, giving businesses ample time to develop and deliver long-term returns. This approach has led her to multibagger stocks, including companies like Nitin Spinners, Monte Carlo Fashions, and Prakash Pipes.

A common theme on the blog is the importance of thorough research. She avoids speculative investments, focusing instead on companies with strong financials, good management, and clear growth paths. Her picks often include mid-sized companies that expand over time, aligning with her growth-oriented philosophy.

Read more: Crypto mize

Frequently Asked Questions

What is the focus of the Dolly Khanna blog?

The blog provides insights into her investment strategies and updates on her portfolio changes, offering guidance to investors

How does the blog help retail investors?

It allows retail investors to learn from her decisions, especially by highlighting small-cap stocks with growth potential.

Who manages the Dolly Khanna portfolio?

Her husband, Rajiv Khanna, oversees the portfolio management with a focus on identifying long-term growth opportunities.

Why is the blog important for stock market enthusiasts?

The blog serves as a valuable resource for those tracking her investments and learning about emerging opportunities in the market.

Conclusion

The Dolly Khanna blog plays a vital role in providing insights into the investment world for retail investors. With a focus on small and mid-cap stocks, the blog offers invaluable knowledge about long-term wealth creation strategies. Dolly Khanna’s approach, rooted in patience and thorough research, has led to significant returns for her portfolio, inspiring countless individuals to follow in her footsteps.

Investors interested in building their portfolios can benefit from the lessons shared on the Dolly Khanna blog. By focusing on fundamentally strong businesses with growth potential, the blog provides readers with the tools to make informed investment decisions. Through careful observation of her portfolio movements and strategies, aspiring investors can learn how to navigate market fluctuations, invest in undervalued stocks, and ultimately achieve financial success.

The Dolly Khanna blog serves not only as a record of her investment journey but also as a guide for those seeking to carve their path in the stock market. Her success stands as a testament to the power of patience, research, and long-term commitment, making her blog an essential resource for anyone looking to understand the nuances of investing.